HOW TO FOLLOW MY ALERTS

Nov 30, 2025

General

Recent Posts

CLICK TO JOIN THE DISCORD | CLICK TO SUBSCRIBE TO THE NEWSLETTER

Hey Insiders,

I get asked all the time: 'I see your alerts, but what do I actually DO with them?'

Fair question. Getting notifications is one thing, but turning them into actionable trades is another.

This guide breaks down exactly how to use my 'Coop Trades' alerts effectively, with real examples from recent trades.

Quick reminder: None of this is financial advice. These are educational examples meant as a starting point for your own research and due diligence.

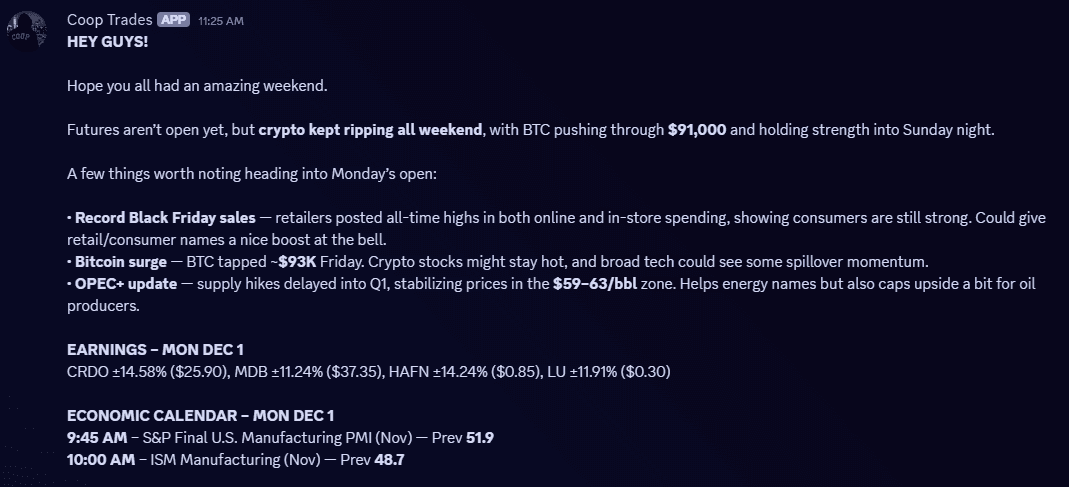

STEP 1: Understanding the Daily Watchlist

The daily watchlist is posted before market open and serves as your market intelligence briefing for the day. This isn't a "buy these stocks" list. It's context to help you understand what's moving and why.

What you'll find in the watchlist:

Nasdaq Analysis - Is tech leading or lagging? This tells you whether to focus on growth or defensive plays.

Earnings Calendar - Which tickers might see volatility, and which to avoid until the dust settles.

Economic Data Releases - PMI, jobs reports, Fed speeches that could move the entire market.

Market-Moving Events - OPEC decisions, geopolitical developments, sector rotation signals.

How to use this:

Don't trade blindly off these updates. Use them to build context for the day. If I mention strong retail sales data, you might watch XRT or consumer discretionary stocks. If crypto is ripping, look at MARA, RIOT, COIN. Connect the dots to find correlated opportunities.

The watchlist tells you WHERE to look. The trade alerts tell you WHEN to act.

STEP 2: Breakdown of Trade Alerts

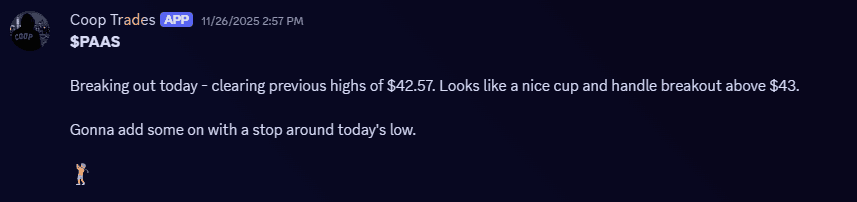

Ticker Symbol: The stock being traded (e.g., $PAAS, $BTC)

Setup Type: The technical pattern I'm seeing (breakout, cup & handle, support bounce, etc.)

For example: $PAAS was breaking out of a cup and handle setup on strong volume to start the trading day, so I sent an alert for a potential swing entry with the complete setup (entry zone, stop loss, and multiple profit targets).

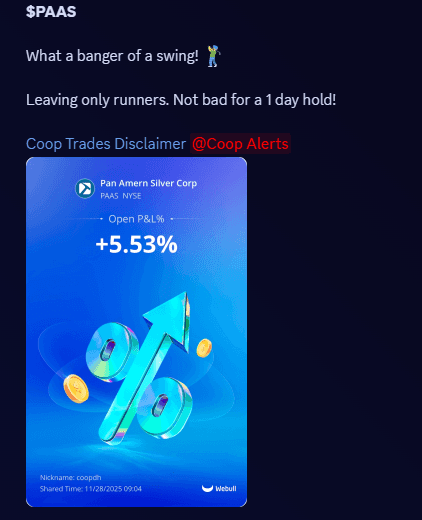

Then I shared when I was taking profit (+5.53% in just 1 day), where I was leaving runners, and how I was managing the position in real-time. This gives you the full picture. Not just the entry, but the entire trade management process.

STEP 3: Types of Trades

DAY TRADES

Day trades capitalize on intraday price volatility. These are quick momentum plays based on technical breakouts, often triggered by volume spikes or key resistance breaks.

Timeframe: Same-day entry and exit

Risk: Tighter stops, smaller position sizes

Targets: Quick 1-3% moves

SWING TRADES

Swing trades are longer-term positions lasting days to weeks. I use CANSLIM methodology combined with options flow data from Unusual Whales to identify high-probability swing setups.

CANSLIM in simple terms:

C: Current quarterly earnings (look for strong EPS growth)

A: Annual earnings (upward trend year over year)

N: New products, services, or leadership driving the stock

S: Supply and demand (low float, high institutional ownership)

L: Leader or laggard (focus on market leaders)

I: Institutional sponsorship (smart money is buying)

M: Market direction (trade with the overall trend)

Options flow data gives me additional confirmation when big money is taking positions. If I see unusual call buying in a stock that's also showing CANSLIM characteristics and a solid technical setup, that's a high-conviction swing trade.

Swing Trade Structure:

I typically start with a starter position (50% of full size)

If the trade moves +5%, I move my stop loss to breakeven (risk-free trade)

Scale out at targets: 50% at T1, 30% at T2, 20% runners

Timeframe: 1-30+ days

Risk: Wider stops to avoid getting shaken out

Targets: 3-10%+ moves

STEP 4: Crypto Trade Ideas

I trade crypto similarly to stocks, but with key differences:

Leverage: 20-125x (significantly amplified risk and reward)

Speed: These are short-term precision strikes, not multi-day holds

Setups: Same technical principles (support/resistance, breakouts, key zones)

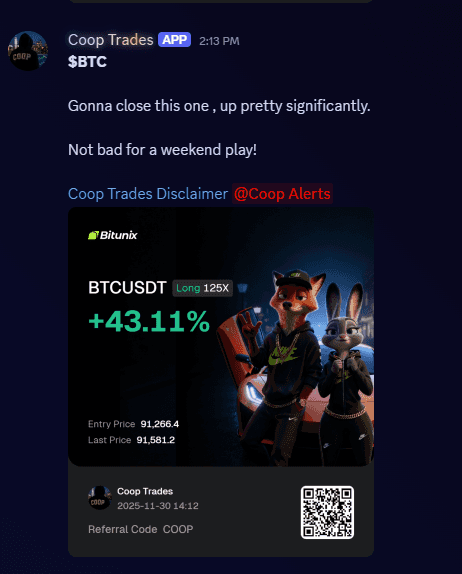

For example: I shared a BTC LONG setup at a key support level with 50x leverage. Just an hour later, I was selling the position with over 45% in profit. That's the speed of crypto. Quick entries, quick exits.

Key difference: Crypto moves FAST. You need to be ready to act immediately when alerts hit, and you need to take profits aggressively. Don't get greedy.

STEP 5: Risk Management

Risk management is the difference between profitable traders and broke traders. Here's my approach:

The 1-2% Rule: Never risk more than 1-2% of your account on any single trade.

How to calculate:

Identify the entry price and stop loss from the alert

Calculate risk per share (Entry minus Stop Loss equals Risk)

Determine how much you're willing to lose (Account Size times 1-2%)

Divide dollar risk by risk per share to get Position size

Example:

Entry: $28.50

Stop Loss: $27.00

Risk per share: $1.50

Account size: $10,000

Max risk (2%): $200

Position size: $200 divided by $1.50 equals 133 shares

STEP 6: Using Charts and Setting Alerts

All my ideas and levels are charted using TradingView. To follow along effectively:

Set up alerts: Configure price alerts at the entry levels, stop loss, and profit targets I share. This ensures you don't miss the setup.

Use the charts: The charts I share are marked with trend lines, support/resistance levels, and moving averages. Use them as visual guides for your own analysis.

Confirm on your own platform: Pull up the ticker yourself. Verify the levels. Add your own indicators (RSI, MACD, volume). Don't just take my word for it. Do your own chart analysis.

STEP 7: Putting It All Together

Here's your workflow for using these alerts:

1. Review the Daily Watchlist - Understand the broader market context before placing any trades.

2. Wait for Trade Alerts - I'll share specific setups when they meet my criteria.

3. Verify the Setup - Pull up the chart, confirm the pattern, check volume.

4. Calculate Position Size - Use the 1-2% rule to determine how many shares/contracts to trade.

5. Plan Your Entry and Exit - Set alerts at entry levels, place stop loss immediately upon entry, know your profit targets.

6. Manage the Trade - Take partials at targets, move stops to breakeven when up 5%, trail runners.

7. Journal the Results - Screenshot the alert and your trade. Track what worked and what didn't.

COMMON MISTAKES TO AVOID

Don't blindly copy every trade - Just because I share a setup doesn't mean it fits your account size, risk tolerance, or trading style. Filter alerts through YOUR plan.

Don't skip stop losses - The moment you ignore them, you've gone from trading to gambling. Honor your stops, every single time.

Don't overtrade - You don't need to take every alert. I might share 5-10 setups per week, but 2-3 well-managed trades beat 10 mediocre ones. Quality over quantity.

Don't ignore context - A breakout setup looks different when the Nasdaq is down 2% vs. up 1%. Always check the watchlist alerts for broader market conditions before entering any trade.

Don't expect 100% win rate - Even the best setups fail 30-40% of the time. The goal isn't winning every trade. It's making more on winners than you lose on losers.

Don't size positions based on confidence - Use the 1-2% rule regardless of how good the setup looks. Overconfidence destroys accounts.

FINAL THOUGHTS

The goal is to teach you to see what I see, think how I think, and eventually spot these setups yourself. Use the watchlists to build market context. Study the trade setups to understand what makes them high-probability. Watch how I manage positions from entry to exit.

Over time, you'll start recognizing these patterns before I post them. You'll know when to take profits, when to cut losses, and when to sit on your hands. That's when you've truly leveled up.

Until then, treat every alert as a learning opportunity. Screenshot them, track the results, journal what worked and what didn't. The education is in the process, not just the profits.

Stay sharp, manage your risk, and remember: discipline beats conviction every single time.

- Coop

QUESTIONS?

If you need clarification on any alerts or have questions about specific setups, reach out in the Discord community. We're all here to learn and grow together.

Disclaimer

—

Equity Insider is a paid advertisement and publication of Market Vision LLC, a Texas LLC. All content is for general educational and informational purposes only and is not individualized investment advice or a solicitation to buy or sell any instrument. Market Vision LLC receives compensation to publish favorable, promotional information about featured instruments; this creates a fundamental and material conflict of interest under SEC Rule 17(b), and you must always assume a conflict exists. The publisher and its affiliates may hold and trade positions in any featured instrument and may liquidate (i.e., "pump and dump") those positions at any time without notice. All trading involves SUBSTANTIAL RISK, including the complete and total loss of all capital. You are SOLEY responsible for your own independent due diligence and investment decisions. By accessing this content, you agree to the full terms, including mandatory binding arbitration in Texas and a WAIVER of jury and class action rights. Read full disclaimer in the footer of this website.