WATCHLIST | 10/4/2025

Dec 3, 2025

Watchlist

Recent Posts

Hey Insiders,

I hope all of you are having an amazing Wednesday evening & enjoying some time away from the screens. I'm trying a different approach to the nightly watchlist - going to be posting my usual nightly watchlist (i.e. earnings, economic calendar, etc) and combining that with my momentum watchlist, updating on any swing or potential swing ideas, etc.

EARNINGS

TD ±3.02% $2.55

BMO ±3.60% $4.57

CM ±3.25% $2.82

KR ±4.53% $3.00

HPE ±6.49% $1.44

ULTA ±6.61% $36.01

DG ±6.55% $7.19

TIGR ±7.95% $0.69

COO ±6.90% $5.24

DOCU ±8.05% $5.69

- Could be good for premium / option sells into ER. High implied move.

IOT ±12.87% $5.02

- Excited to see what this one does. High R/R.

HRL ±4.50% $1.05

ECONOMIC CALENDAR

8:30 AM ET - U.S. Trade Deficit (October) | Consensus: -$59.6B

8:30 AM ET - Initial Jobless Claims (November)

Quick thoughts:

- Trade deficit data usually doesn't move markets much unless it's a big surprise

- Initial claims is more market-moving - watch for any spikes that might signal labor market weakness

- Both hit at the same time (7:30 AM CT / 8:30 AM ET) an hour before the open.

MOMENTUM WATCHLIST

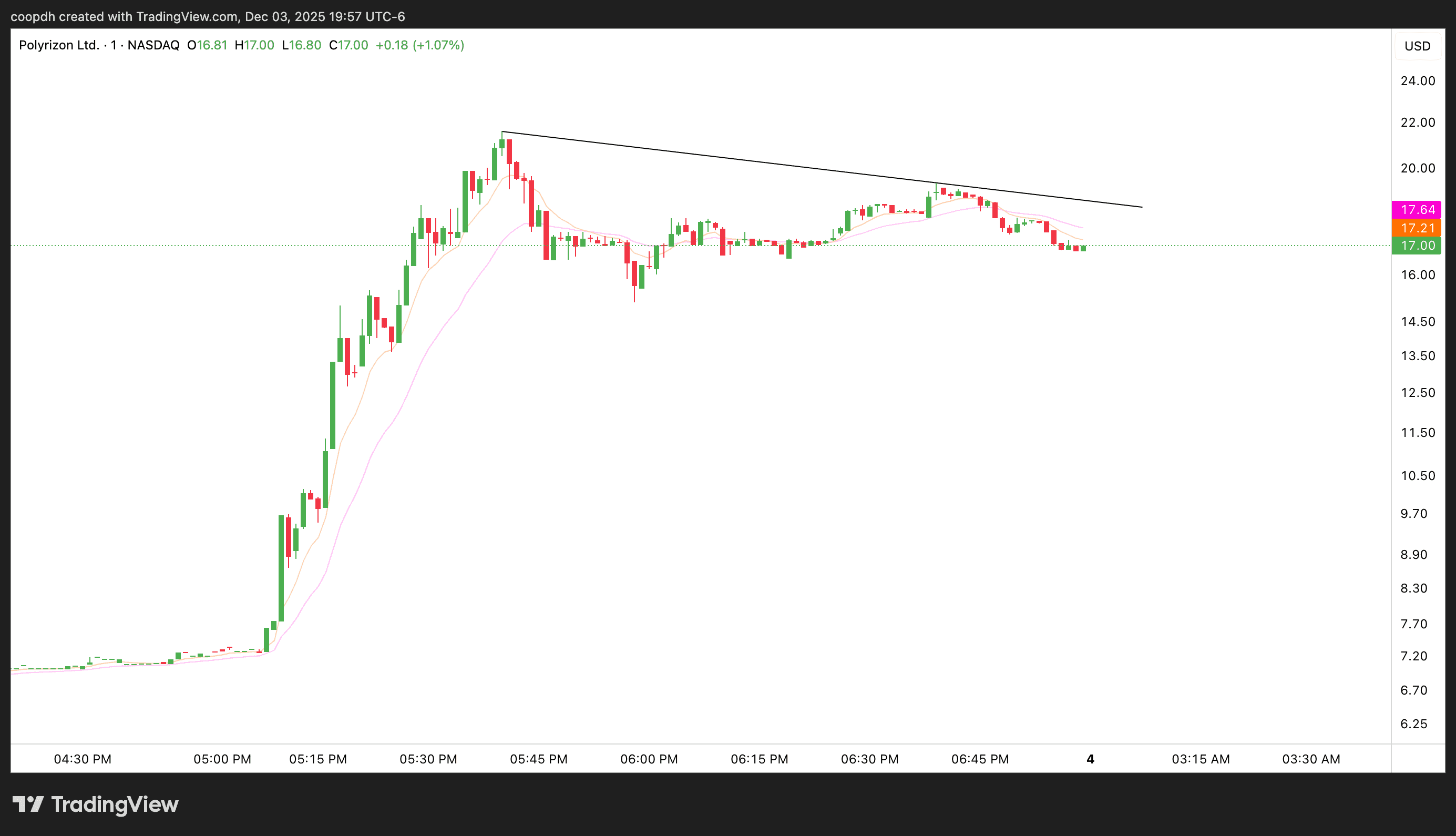

$PLRZ

Top after-hours gainer on the day. Needs a clean $20 psyche break and this one could definitely run tomorrow either at 4 AM or throughout the day.

SWING WATCHLIST

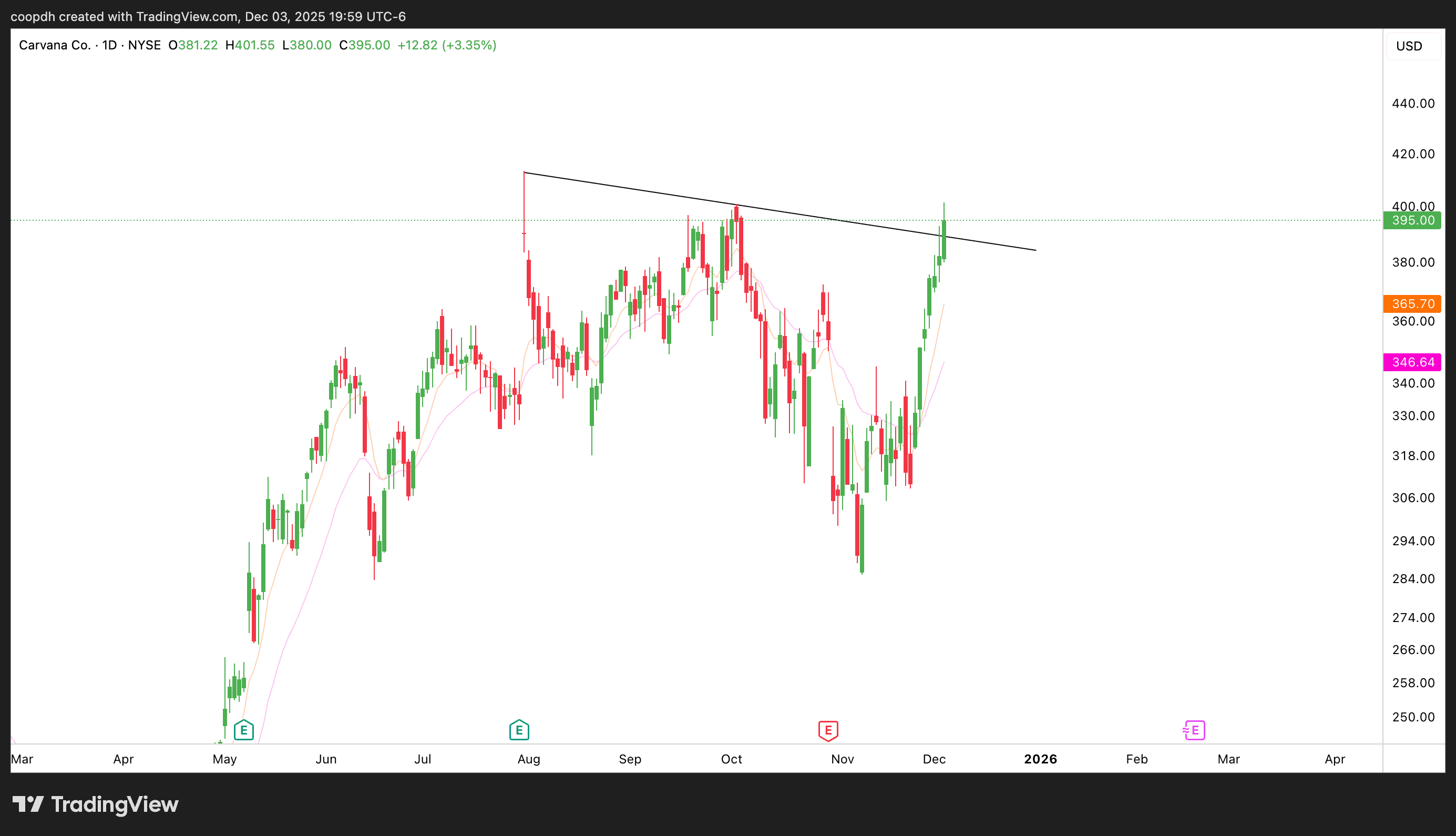

$CVNA

Looks to be breaking out nicely on the daily time frame. Pretty over-extended - but could still play if we clear pivot at $400.

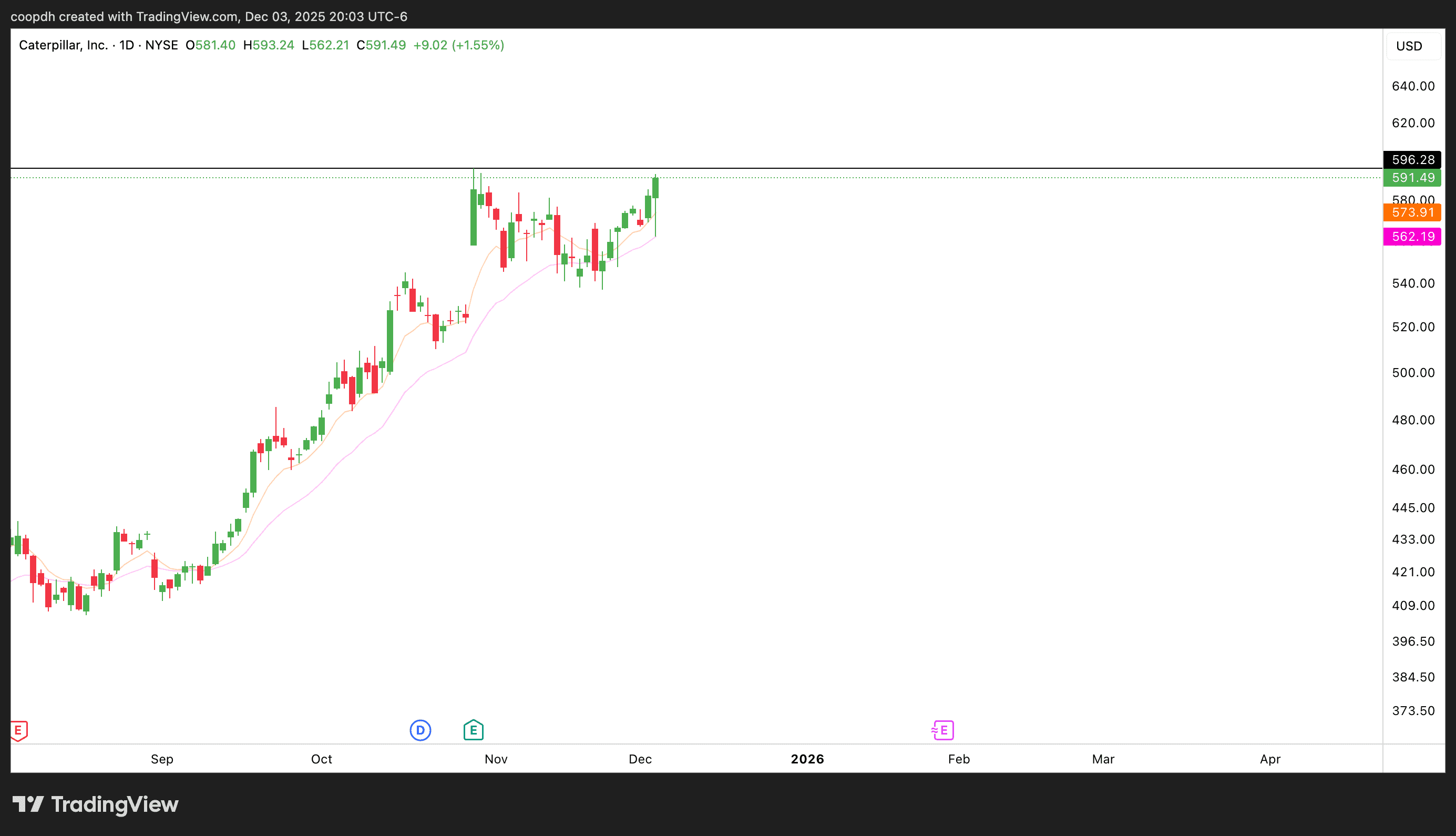

$CAT

Looks to break previous ATH above $596. Nice daily bounce on the 21ma.

MARKET INFORMATION

Trump's Fed Chair Lean President-elect signals decision on next Fed head - front-runner Kevin Hassett (ex-CEA chair) is vocally pro-aggressive cuts. Traders pricing in extra 2026 easing (around 75bp more than prior), lifting small-caps (Russell +1.9%) and cyclicals like industrials/autos.

ADP Payrolls Shock US private sector shed 32K jobs in November vs. +100K expected - biggest drop in 2+ years. Signals labor softening, spiking Fed December 18th cut odds to 89% (from around 67% last month). Bonds rallied (2Y yield to 3.48%), equities followed: Dow +409 (+0.86%) to 47,883 ATH territory, S&P +0.3% to 6,850 (0.6% off October record), Nasdaq +0.17%. Services PMI beat at 52.7 eases recession fears but keeps "bad news is good news" vibe alive for risk assets.

Anyways…

That's all for now, folks!

- Your Friendly Editor @ EquityInsider.net

Disclaimer

Equity Insider is a paid advertisement and publication of Market Vision LLC, a Texas LLC. All content is for general educational and informational purposes only and is not individualized investment advice or a solicitation to buy or sell any instrument. Market Vision LLC is not registered with the SEC, FINRA, CFTC, or any other regulatory agency, and no fiduciary relationship is created by your use of this content.

Market Vision LLC receives compensation to publish favorable, promotional information about featured instruments; this creates a fundamental and material conflict of interest under SEC Rule 17(b), and you must always assume a conflict exists. The publisher and its affiliates may hold and trade positions in any featured instrument and may liquidate (i.e., “pump and dump”) those positions at any time without notice. The publisher makes no warranties, undertakes no duty to update, and is not responsible for statements made by issuers, promoters, or third parties. Some content may include forward-looking statements that are inherently speculative and may differ materially from actual results.

All trading involves SUBSTANTIAL RISK, including the complete and total loss of all capital. You are SOLELY responsible for your own independent due diligence, legal/tax compliance, and investment decisions. By accessing this content, you agree to the full terms, including mandatory binding arbitration in Texas and a WAIVER of jury and class action rights.

Read the full disclaimer in the footer of this website.