Watchlist | 12/9/2025

Dec 8, 2025

Watchlist

Recent Posts

Hey Insiders,

I hope all of you had an amazing and successful trading day today.

Futures are barely green heading into Monday with tech holding modest gains while small caps lag. The calm feels deliberate as traders position ahead of Wednesday's Fed meeting, where a 25 bps cut is almost fully priced in.

FUTURES

Nasdaq (NQ): +0.10% — Tech leading but subdued ahead of Fed.

S&P 500 (ES): +0.08% — Slightly green, cautious tone prevails.

Dow (YM): -0.01% — Flat, industrials showing no conviction.

Russell (RTY): -0.11% — Small caps weak, rate sensitivity showing.

SECTOR FLOW

Semis: Leading group on Nvidia's China export approval. NVDA, AMD, AVGO getting early bids.

Software/Cloud: IBM acquiring Confluent for $11B has traders eyeing other enterprise software names for M&A potential.

Media: Paramount's $30/share hostile bid for Warner Bros. creating volatility. Streaming wars heating up again.

EVs: Under pressure after Morgan Stanley downgrades across TSLA, LCID, RIVN. Soft demand outlook through 2026.

Utilities/Nuclear: AI data center grid bottleneck story gaining traction. 44 GW planned vs. 25 GW capacity could benefit power infrastructure plays.

MARKET NEWS

Fed Meeting Starts Wednesday

Polymarkets are pricing in over 95% chance of a 25 bps cut, meaning the markets are very likely already pricing in the cut. The real event Wednesday will be Powell's press conference where we get to hear their optimism for 2026 cuts.

Rate-sensitive sectors could see volatility around the announcement. (REITs, homebuilders, utilities)

Any hawkish tone on 2026 cuts could trigger some bleeding in already over-extended tech names.

Watch bond yields as well, a spike would pressure growth stocks.

Nvidia Wins China H200 Export Approval

The Trump admin deal will allow shipments to approved Chinese buyers with the requirement that they share 25% of that revenue with the United States.

$NVDA up 1.7% after-hours

Opens the door for other chip names to follow the same path. ($AMD, $AVGO, $TSM, etc.)

IBM Acquiring Confluent for ~$11B

Big deal to boost $IBM's AI and data streaming capabilities. $CFLT up over 30% after that announcement early this morning.

Paramount's Hostile Bid for Warner Bros.

Thought that Netflix closed their Warner Bros. deal? Think again. Paramount just offered $30/share CASH for the company in front of the potential Netflix deal.

Media sector is seeing pressure again

Watch for volatility in $NFLX and $WBD

MOMENTUM WATCHLIST

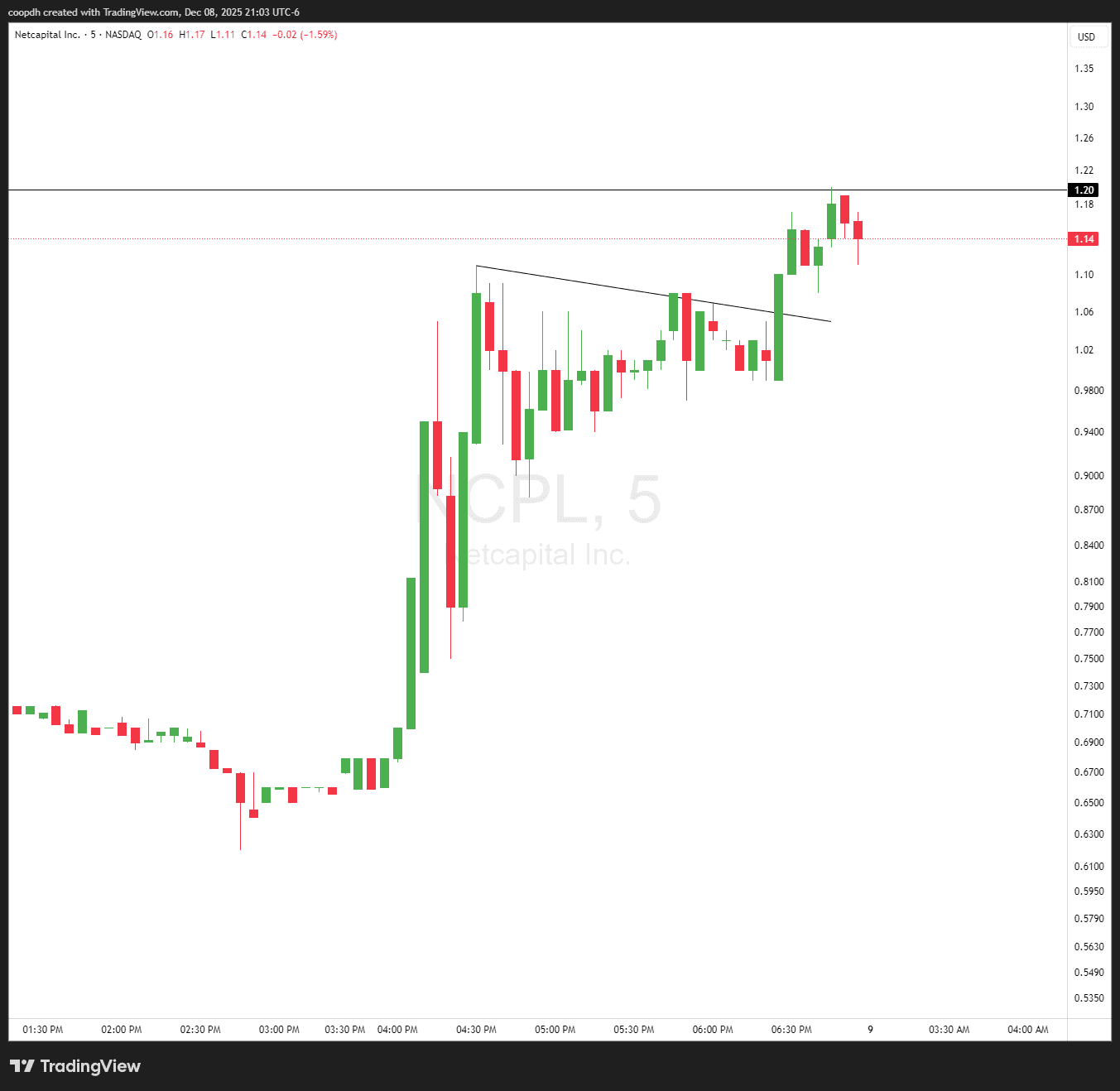

$NCPL

Just got a new CEO [SOURCE] today which started their very bullish after-hours run.

Watching for a $1.20 BREAK with momentum either at 4 AM or in the pre-market tomorrow for potential entry's. Looks primed with a sub 4 mil market cap.

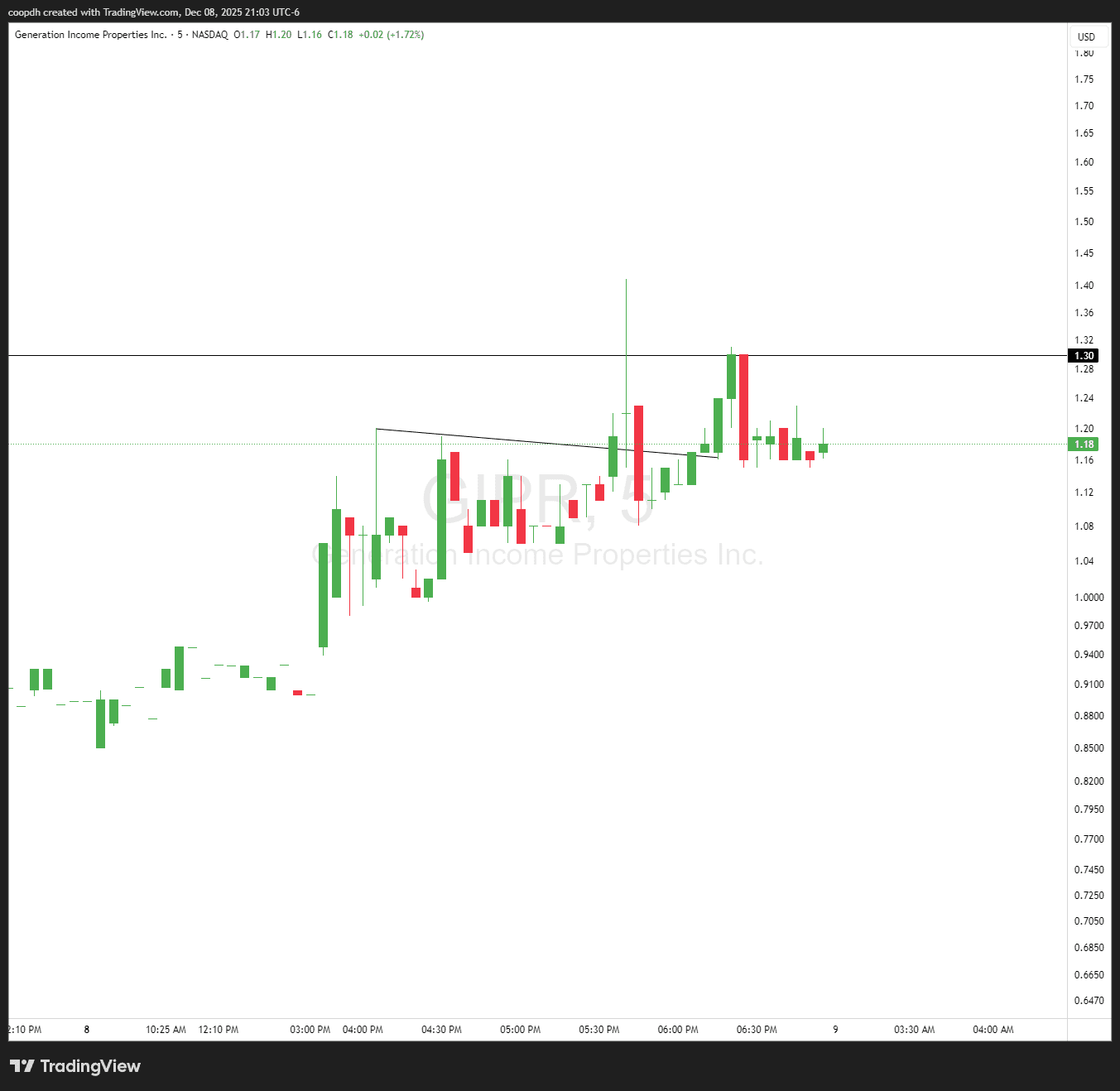

$GIPR

No news on this one but it caught looks after the close today. Watching for a $1.300 BREAK with volume for potential buys if we can hold it up. Super thin on this one as well and if it catches the scanners tomorrow it's gone.

SWING WATCHLIST

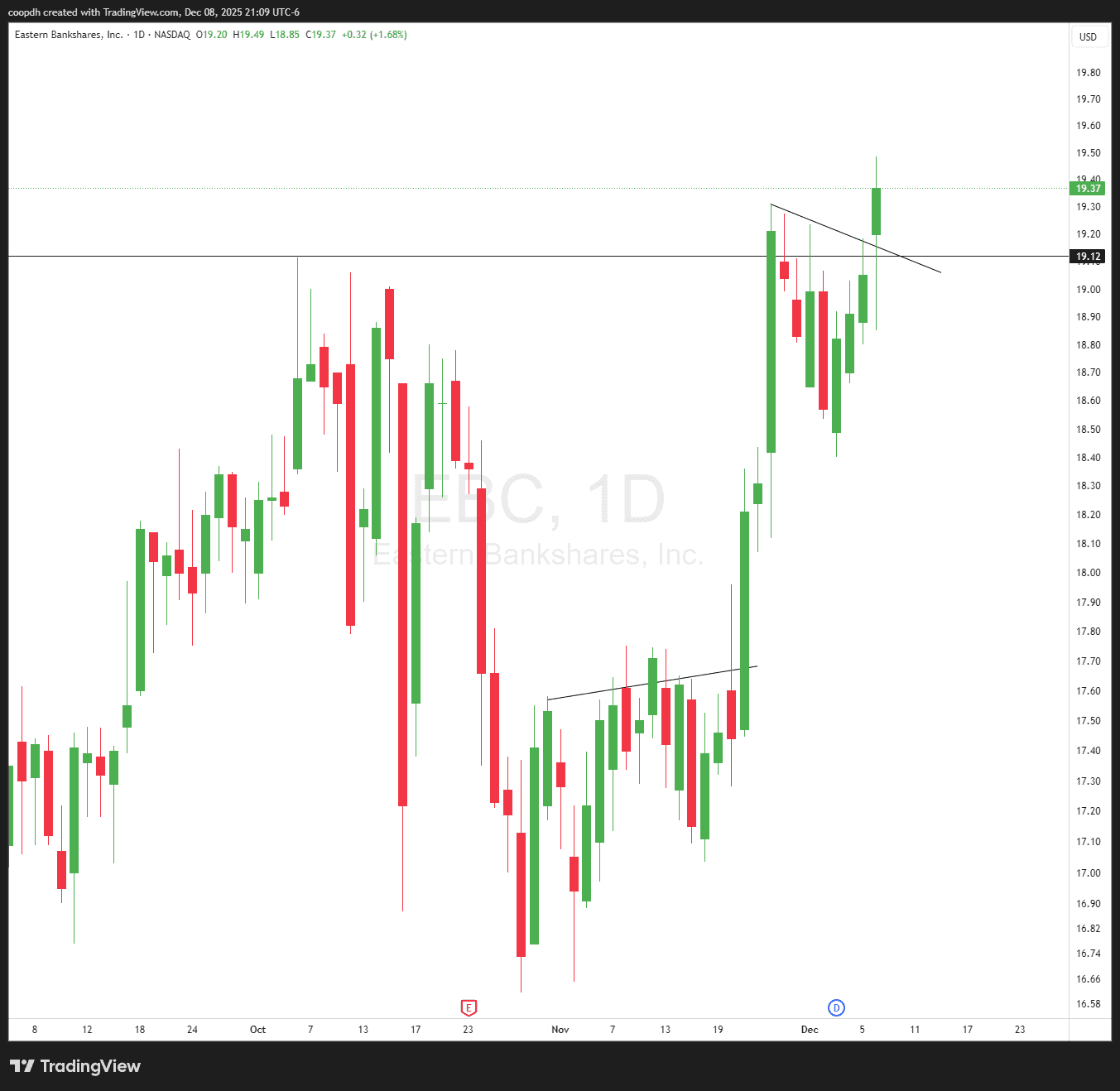

$EBC

Banks have been doing very well recently, and this one is no exception. Showing significant strength on the daily candle today closing above significant resistance levels.

Looks primed for an entry for either a momentum trade or a swing with targets of $20+.

Looking forward to tomorrow;

EARNINGS

Before Market Open (PM):

CASY, AVAV, GME

After Market Close (AH):

AZO, SAIL, CNM, CPB

ECONOMIC CALENDAR

6:00 AM: NFIB Optimism Index (November) - 98.3 est

10:00 AM: Job Openings/JOLTS (October, delayed report) - 7.2M est

Anyways…

Thanks for reading, and that's all for now!

- Your Friendly Editor @ EquityInsider.net

Disclaimer: Equity Insider is a publication of Market Vision LLC, a Texas LLC.

This content is for general educational and informational purposes only and is not individualized investment advice or a solicitation to buy or sell any instrument.

Market Vision LLC is not registered with the SEC, FINRA, or any other regulatory agency, and no fiduciary relationship is created by your use of this content.

The publisher and its affiliates may hold and trade positions in any instrument mentioned and may liquidate those positions at any time without notice.

All trading involves SUBSTANTIAL RISK, including the complete loss of all capital. You are SOLELY responsible for your own due diligence and investment decisions.

By accessing this content, you agree to the full terms, including mandatory binding arbitration in Texas and a WAIVER of jury and class action rights. Read the full terms in the footer of this website.