WATCHLIST | 12/5/2025

Dec 4, 2025

Watchlist

Recent Posts

Hey Insiders,

I hope all of you are having an amazing Thursday evening. Some quick notes about tomorrow's trading day below & I'll let you guys get back to what you were doing.

EARNINGS

No major companies reporting earnings tomorrow.

ECONOMIC CALENDAR

10:00 AM ET - Consumer Sentiment (Prelim) (December) | Consensus: 51

3:00 PM ET - Consumer Credit (October) | Consensus: $13.1B

Quick thoughts:

Consumer sentiment can move markets if we see a big surprise - sentiment has been pretty volatile lately

Consumer credit data usually doesn't move markets much unless there's a significant deviation

Sentiment data hits at 9:00 AM CT / 10:00 AM ET, so watch for any immediate reaction in the first hour of trading

MOMENTUM WATCHLIST

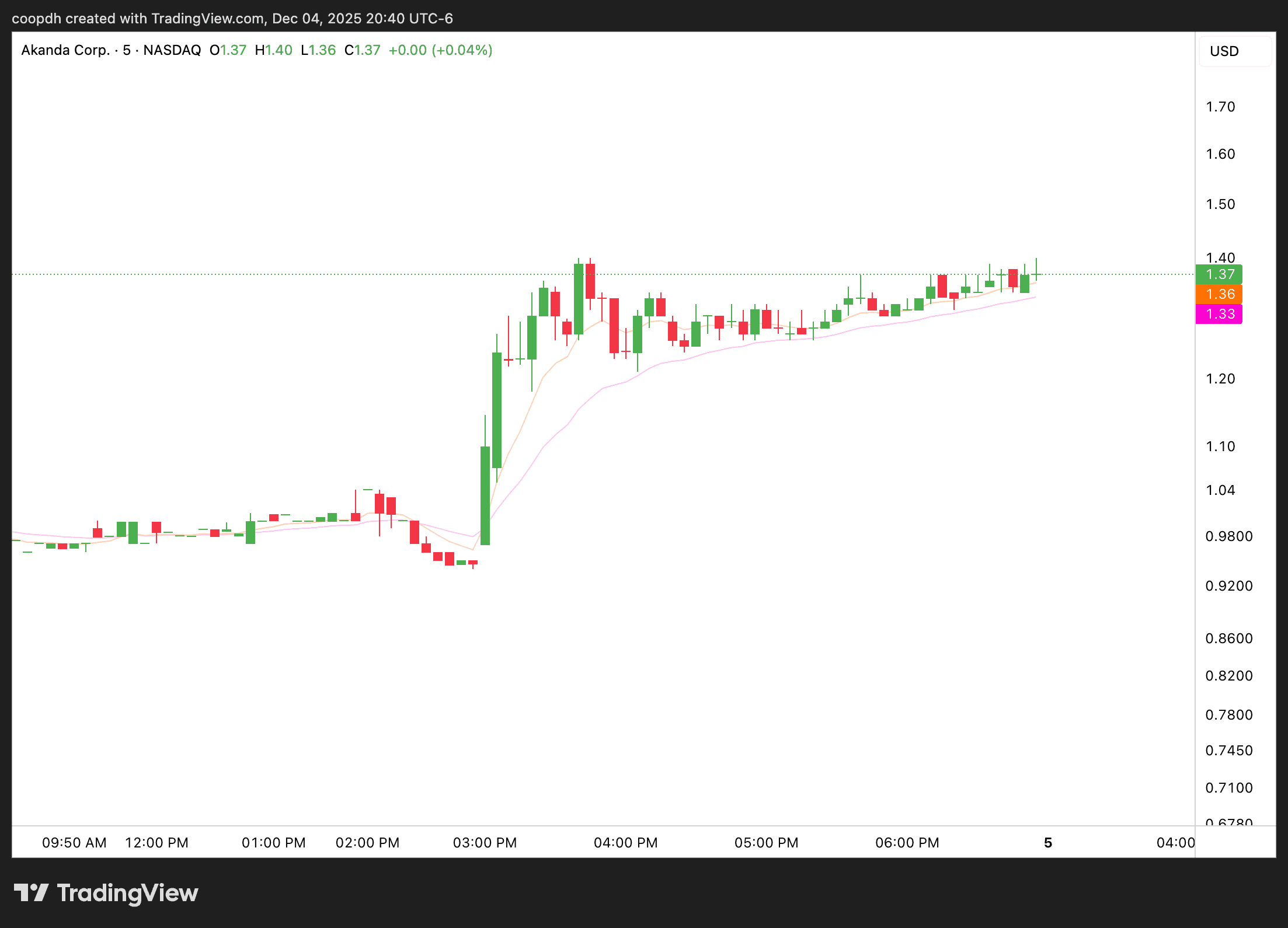

$AKAN

TOP WATCH FOR TOMORROW!

Looking very very nice for potential 4 AM pop or pre-market run. Watch for the $1.40 break and hold with momentum. Around 700k shares in the float - super thin mover. Could squeeze hard if we get the right volume.

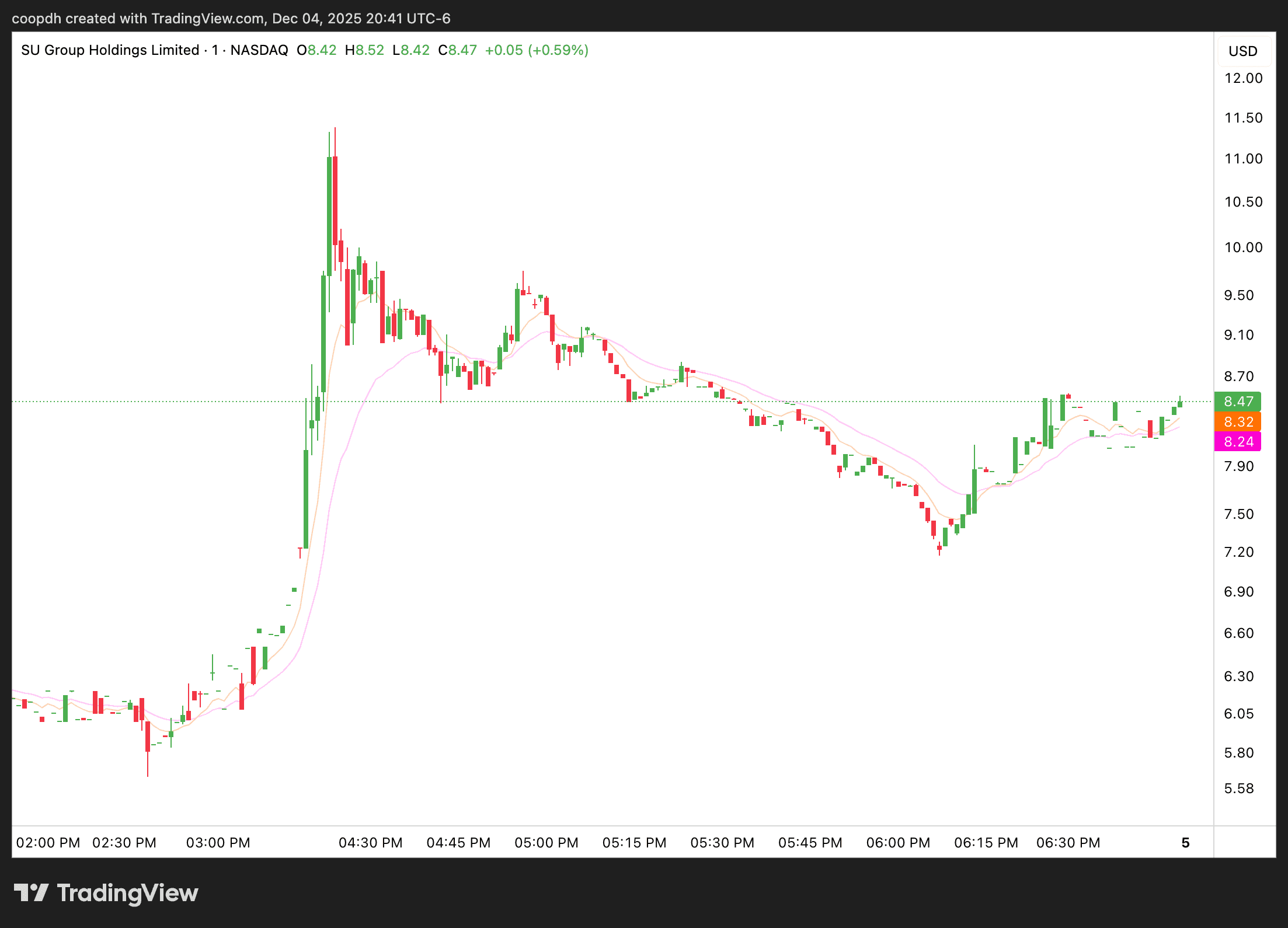

$SUGP

$9.60 pivot BREAK could be good. Also has a nice lower-sized float. If this one clears that level cleanly, could see a decent continuation move.

SWING WATCHLIST

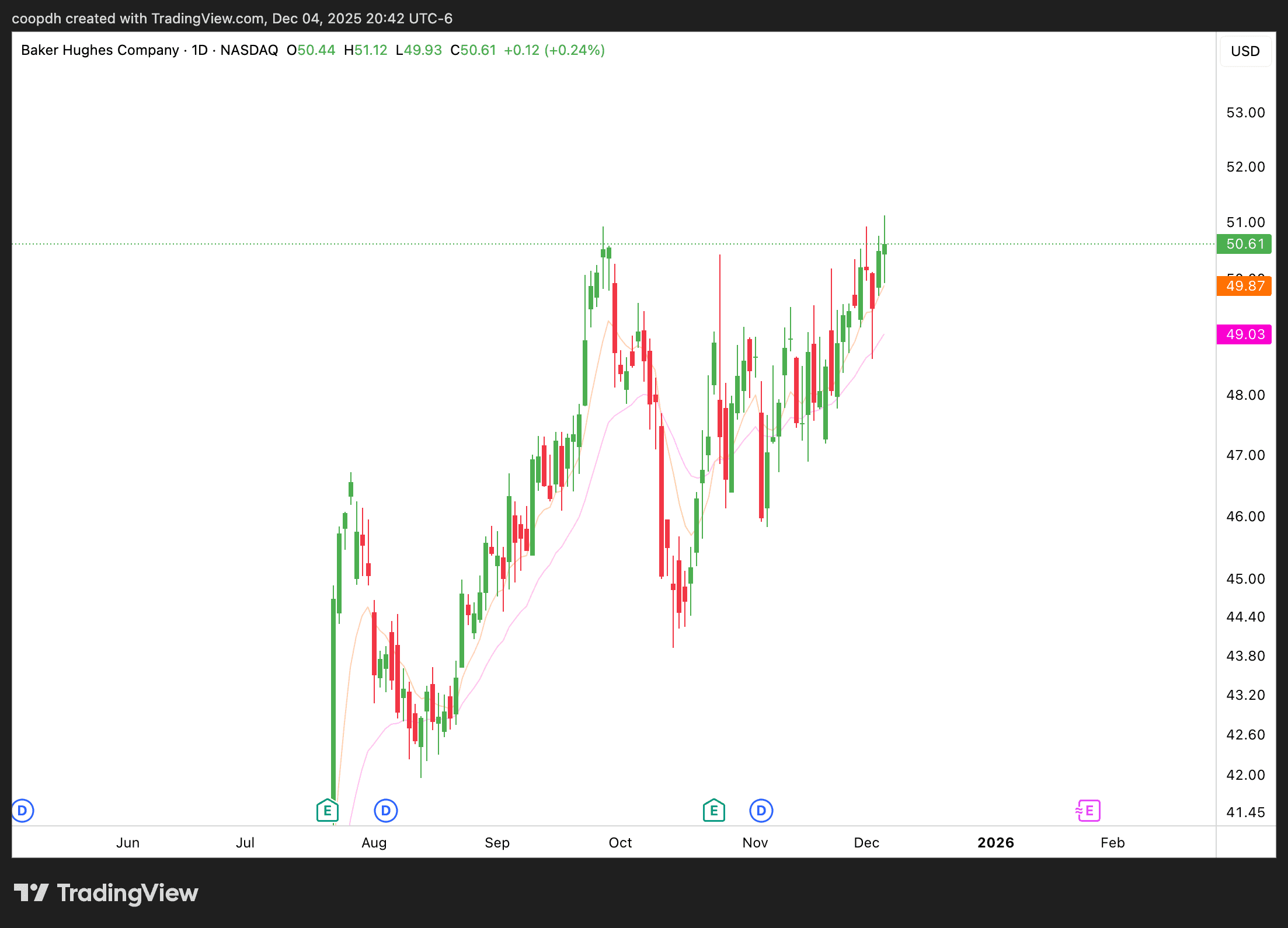

$BKR

Wicky - but closed with higher than average volume and closed just below pivot ($50.50). I entered some yesterday with a stop around $50. Looking for a clean break and hold above that level for continuation.

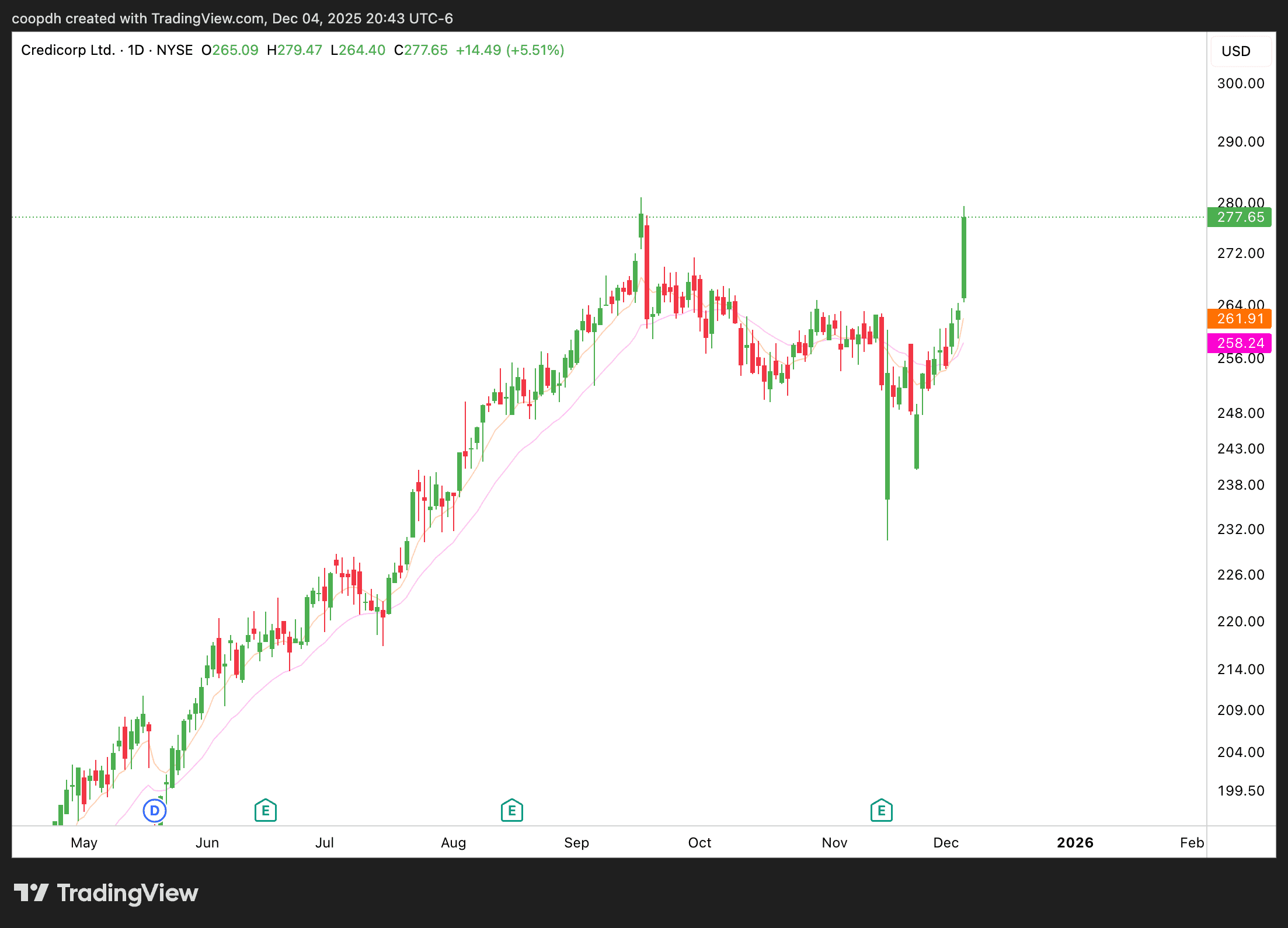

$BAP

SUPER strong intraday idea alerted on my Coop Trades alert bot. I trimmed most intraday for over 5% but I'm still holding a small position. Beautiful break of pivot on huge volume. Awesome trade - keeping runners for potential follow-through.

MARKET INFORMATION

Choppy Consolidation Continues

I'm really just waiting for the market to pick a direction. We've been trading at VERY similar levels recently and it's making directional trades very tough. Need the market to choose up or down and stick with it. S&P continues to hover near all-time highs but lacks conviction either way. Volume has been relatively light, suggesting traders are waiting for a catalyst. Tomorrow's consumer sentiment data could provide that spark we need to break out of this range.

Anyways...

That's all for now, folks!

- Your Friendly Editor @ EquityInsider.net

Disclaimer: Equity Insider is a paid advertisement and publication of Market Vision LLC, a Texas LLC. All content is for general educational and informational purposes only and is not individualized investment advice or a solicitation to buy or sell any instrument. Market Vision LLC is not registered with the SEC, FINRA, CFTC, or any other regulatory agency, and no fiduciary relationship is created by your use of this content.

Market Vision LLC receives compensation to publish favorable, promotional information about featured instruments; this creates a fundamental and material conflict of interest under SEC Rule 17(b), and you must always assume a conflict exists. The publisher and its affiliates may hold and trade positions in any featured instrument and may liquidate (i.e., "pump and dump") those positions at any time without notice. The publisher makes no warranties, undertakes no duty to update, and is not responsible for statements made by issuers, promoters, or third parties. Some content may include forward-looking statements that are inherently speculative and may differ materially from actual results.

All trading involves SUBSTANTIAL RISK, including the complete and total loss of all capital. You are SOLELY responsible for your own independent due diligence, legal/tax compliance, and investment decisions. By accessing this content, you agree to the full terms, including mandatory binding arbitration in Texas and a WAIVER of jury and class action rights. Read the full disclaimer in the footer of this website.