Watchlist | 12/8/2025

Dec 7, 2025

Watchlist

Recent Posts

Hey Insiders,

I hope all of you had an amazing weekend. I had an amazing weekend away from the charts and I hope all of you did the same.

FUTURES are trading slightly higher this afternoon since Friday's close.

Nasdaq (NQ): Slightly green, up about +0.09%. Mild upward drift - nothing aggressive, but positive momentum.

S&P 500 (ES): Also up, around +0.06%. Quiet, steady, leaning bullish.

Dow (YM): Slightly red, down about -0.03%. Lagging the others a bit, showing minor weakness.

Russell 2000 (RTY): Up roughly +0.11%. Small-caps showing a bit more strength than the large-cap indices.

Overall: Mixed but leaning positive, with tech and small-caps leading while the Dow drags slightly.

EARNINGS

TOL ±6.05% $8.41

LU ±7.76% $0.20

PHR ±10.83% $2.20

YEXT ±7.67% $0.68

CMP ±10.69% $2.17

ECONOMIC CALENDAR

Nothing of note on the economic calendar for tomorrow's trading day.

MOMENTUM WATCHLIST

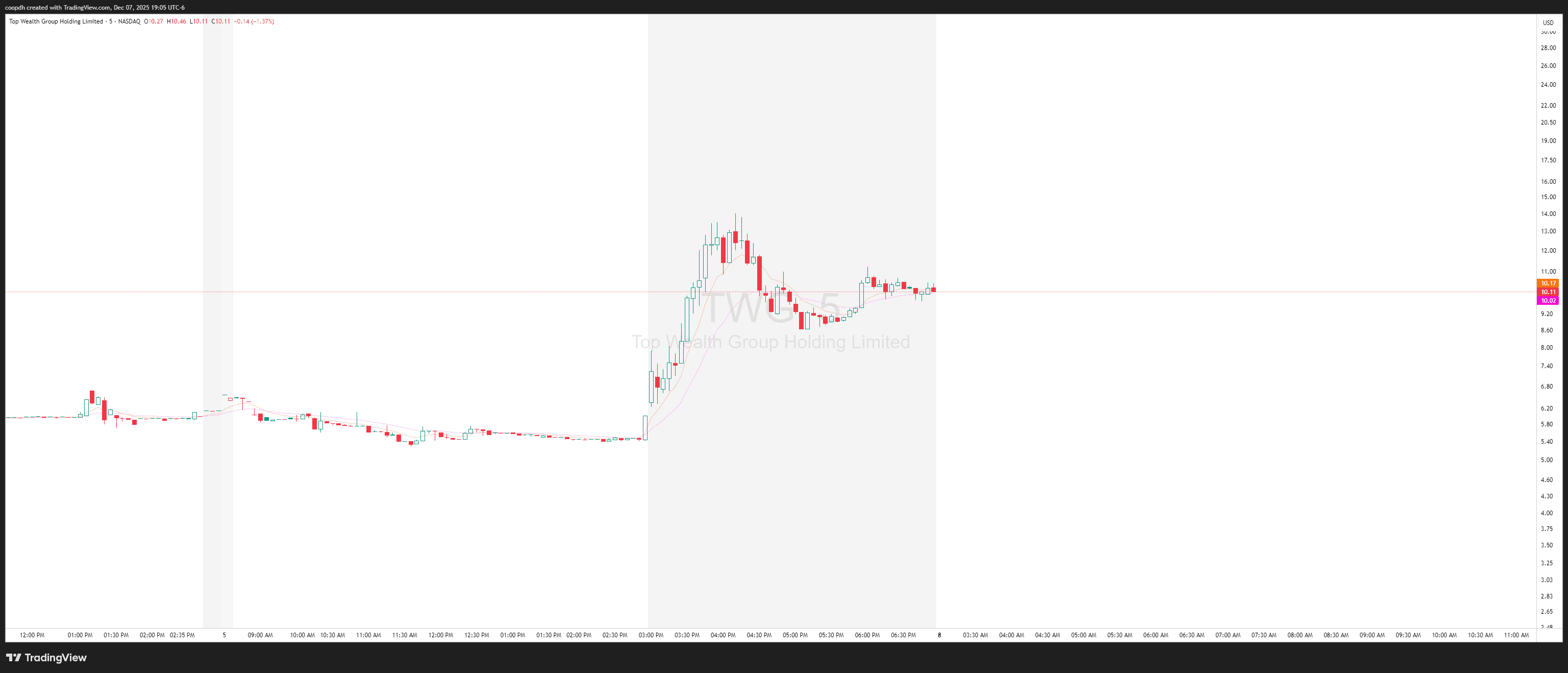

$TWG

Lower float on this one in particular - a nice $11.50 clean breakout could send this one flying early in tomorrow's trading day.

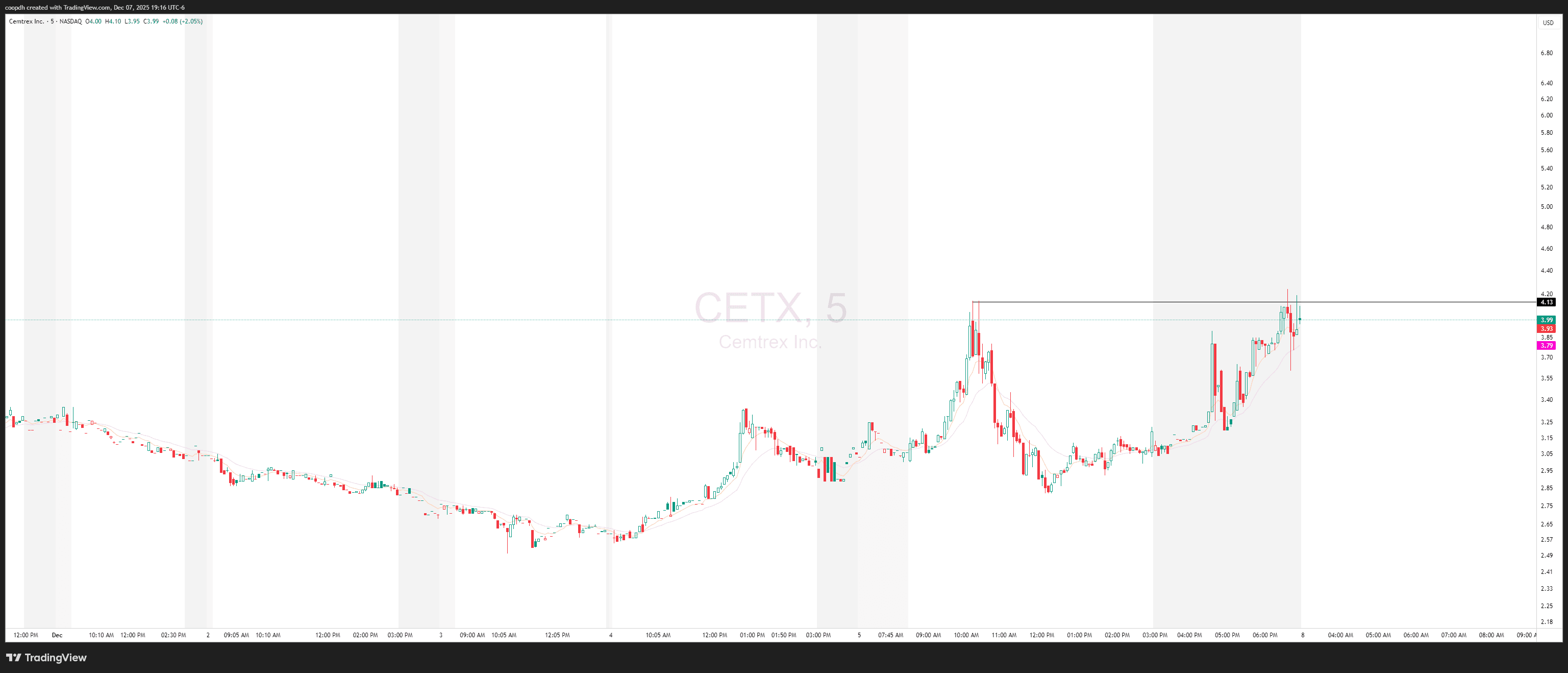

$CETX

Another low-float that is setting up nicely for a potential 4 AM / pre-market pop. If we can clear $4.20+ on volume - shouldn't have too hard of a time sending this thing shooting higher.

SWING WATCHLIST

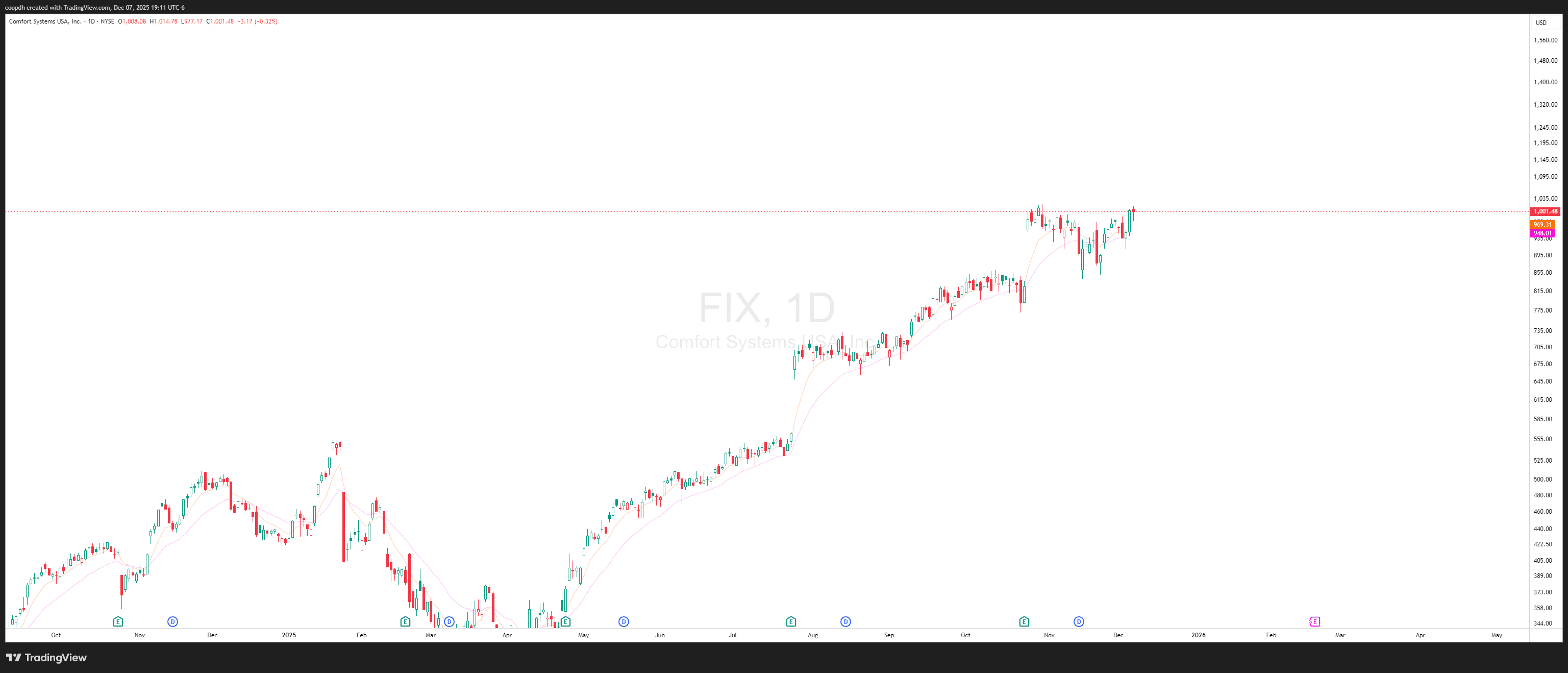

$FIX

Just an amazing uptrend all year. Trading around the $1,000 key psychological level. Really good fundamentals, gonna be watching this one on the lower time frames for a potential entry.

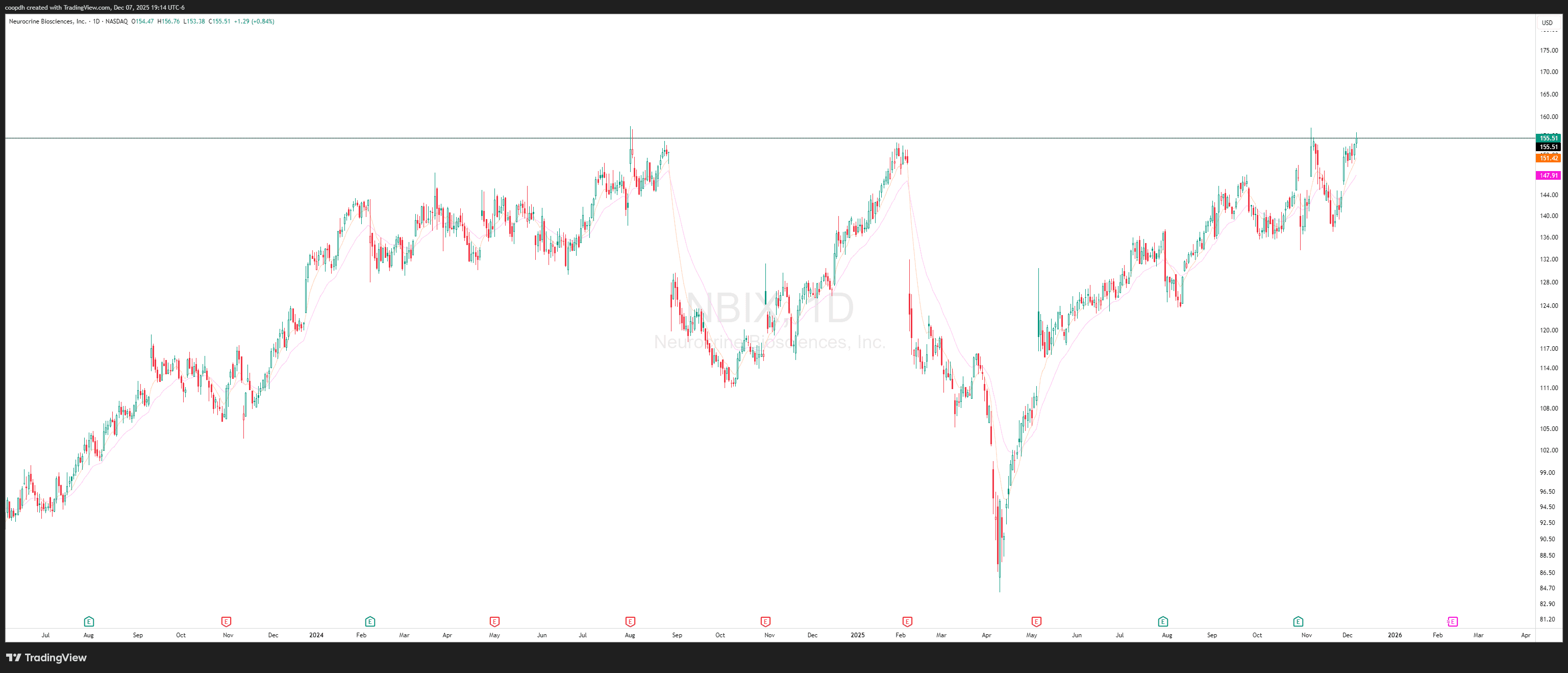

$NBIX

Testing very significant resistance here on the daily. Waiting to see if some volume can come in and support a push over those previous highs / zones of resistance. Great fundamentals on this one as well that I'll be watching very closely tomorrow.

MARKET INFORMATION

Fed Rate Cut Looking Likely

The market is basically pricing in an 87% chance of a quarter-point rate cut at the Fed meeting this week (December 9-10). That's up from 85% on Friday after some Fed officials sounded pretty dovish. This should be good for stocks, but the dollar's been weakening to 5-week lows and we might see some hesitation heading into the actual announcement. Real focus will be on Powell's comments and what they're projecting for 2026.

Asia Shaky, Europe Holding Up

Asian markets opened pretty cautious overnight - Japan's dealing with potential rate hikes pushing their bond yields to the highest since 2007, and China's stimulus plans haven't really impressed anyone. That weakness could bleed into US energy and mining stocks. Europe actually held up okay last week though, so the damage might be contained if the Fed stays dovish.

Bonds and Commodities Getting Defensive

Treasury yields are sitting around 4.27% after spiking Friday, oil's down a bit on demand concerns, and gold's hanging around $4,200 as everyone bets on rate cuts. Probably going to see some choppiness in rate-sensitive sectors like real estate and banks tomorrow. The VIX could tick up a bit if yields stay firm - might see a rotation out of momentum plays into safer names with this week's Fed meeting coming up.

Anyways...

That's all for now, folks!

- Your Friendly Editor @ EquityInsider.net

Disclaimer: Equity Insider is a paid advertisement and publication of Market Vision LLC, a Texas LLC. All content is for general educational and informational purposes only and is not individualized investment advice or a solicitation to buy or sell any instrument. Market Vision LLC is not registered with the SEC, FINRA, CFTC, or any other regulatory agency, and no fiduciary relationship is created by your use of this content.

Market Vision LLC receives compensation to publish favorable, promotional information about featured instruments; this creates a fundamental and material conflict of interest under SEC Rule 17(b), and you must always assume a conflict exists. The publisher and its affiliates may hold and trade positions in any featured instrument and may liquidate (i.e., "pump and dump") those positions at any time without notice. The publisher makes no warranties, undertakes no duty to update, and is not responsible for statements made by issuers, promoters, or third parties. Some content may include forward-looking statements that are inherently speculative and may differ materially from actual results.

All trading involves SUBSTANTIAL RISK, including the complete and total loss of all capital. You are SOLELY responsible for your own independent due diligence, legal/tax compliance, and investment decisions. By accessing this content, you agree to the full terms, including mandatory binding arbitration in Texas and a WAIVER of jury and class action rights. Read the full disclaimer in the footer of this website.