Pan American Silver: A Precious Metals Play with Serious Momentum

Nov 27, 2025

Investing

Recent Posts

Hey Insiders,

Let me cut straight to it. I just opened a position in Pan American Silver (PAAS), and I want to walk you through exactly why this name caught my attention right now.

The stock's up 94% year-to-date. That kind of move usually sends me running in the other direction. But here's the thing—the underlying fundamentals suggest we're nowhere near done. When I see a stock ripping higher and still trading at a 59% discount to fair value on a DCF basis, I pay attention.

The Silver Backdrop Nobody's Talking About

Silver's having a moment, and it's not just the usual safe-haven narrative.

Industrial demand is surging. Solar panels, electric vehicles, 5G infrastructure—they all devour silver at an accelerating rate. Supply can't keep up. Global mine production has been flat to declining for years while fabrication demand keeps climbing. That gap creates the kind of structural tightness that can sustain higher prices for quarters, not weeks.

PAAS sits right in the middle of this setup. The company isn't some single-asset junior gambling on one deposit. It's a diversified producer with operations across the Americas. Scale matters in this environment. When margins expand, the operating leverage on a portfolio of assets compounds fast.

The Earnings Inflection Is Real

Wall Street expects earnings to jump 86% to $1.47 per share. That's not a hope—it's baked into production schedules and cost structures already visible in the numbers.

Q2 delivered record output. Management didn't just meet guidance. They beat it and raised the bar for the back half of the year. New discoveries at La Colorada extend mine life and add high-grade ounces to the reserve base. This isn't a story about squeezing the last bit out of aging assets. It's about expanding the runway.

Then there's the MAG Silver acquisition. That deal closed earlier this year and immediately upgraded PAAS's asset quality. Higher-grade deposits. Lower all-in sustaining costs. Better margins at every price point. Acquisitions usually take time to integrate and deliver value. This one's already showing up in the cash flow statement.

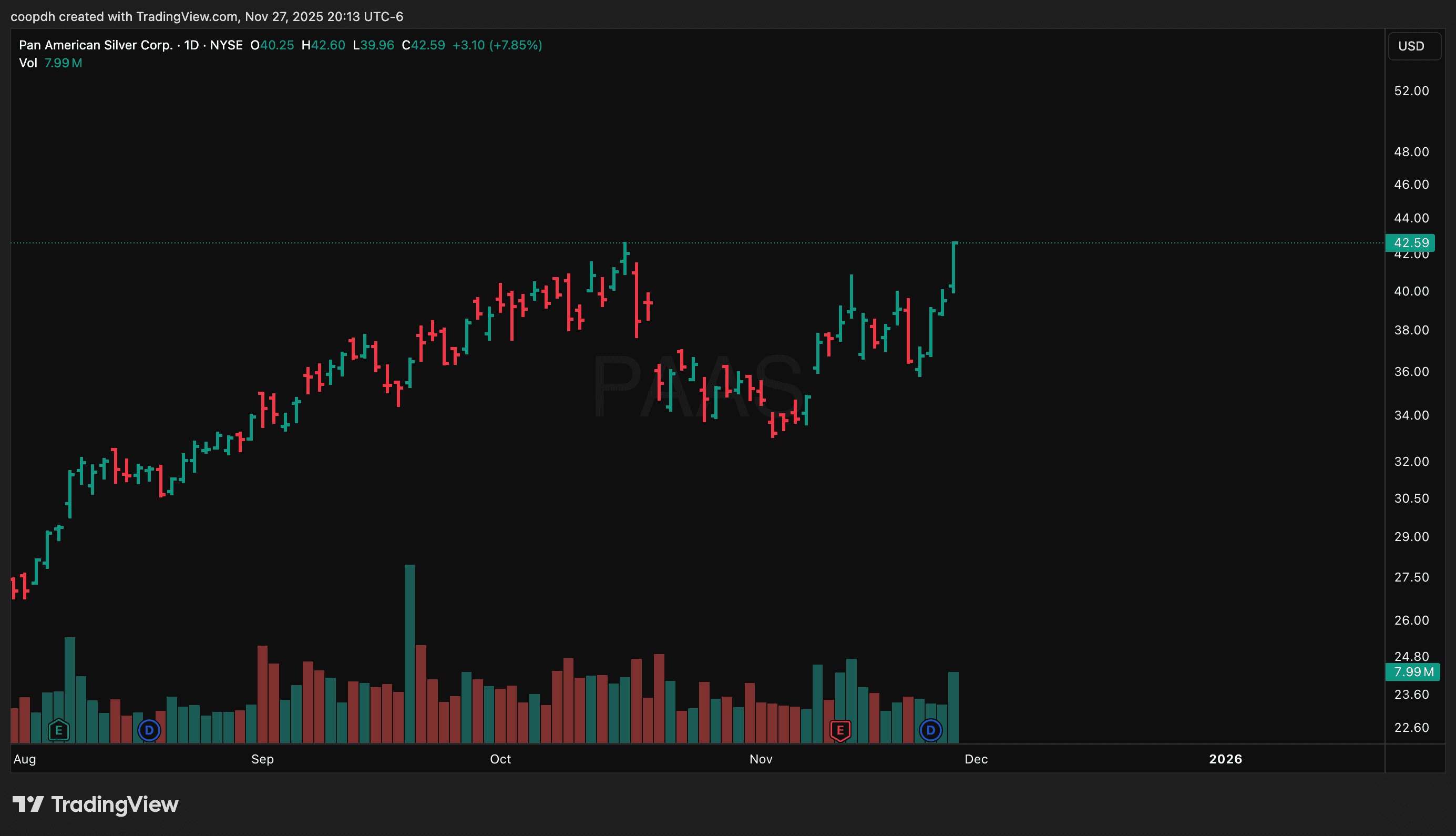

Technical Setup Confirms the Fundamental Thesis

I don't ignore the chart when the fundamentals line up. PAAS just broke through resistance that held it down for months. Volume spiked on the move, confirming institutional interest. Relative strength rating sits in the top tier compared to peers.

Breakouts after long consolidations backed by strong RS tend to run further than most expect. The market's telling us something here. Smart money is accumulating while retail still chases yesterday's winners.

What's the Upside?

Conservative models point to 25-40% gains from current levels over the next 12-18 months. That assumes silver stays in its recent range and PAAS simply executes on stated production targets. If we get any upside surprise on metal prices or operational performance, those targets move higher fast.

The risk-reward ratio works. Downside protection comes from the asset base, reserve growth, and a management team that's proven they can navigate cycles. Upside comes from operational leverage, continued silver strength, and a valuation that still hasn't priced in the full earnings power of this combined entity.

Why Now?

Timing matters. PAAS isn't a trade. It's a position built around a macro theme—precious metals resilience in a volatile world—paired with a company hitting its stride operationally.

Geopolitical uncertainty isn't fading. Currency debasement fears aren't going away. Industrial demand for silver isn't reversing. PAAS benefits from all three while trading like the market hasn't connected those dots yet.

I'm not predicting the top in silver or claiming PAAS doubles from here tomorrow. What I'm saying is the setup warrants exposure. The fundamentals, the technicals, and the macro backdrop all point in the same direction.

That's rare enough to act on.

Anyways…

That's all for now!

- Equity Insider

Disclaimer

—

Equity Insider is a paid advertisement and publication of Market Vision LLC, a Texas LLC. All content is for general educational and informational purposes only and is not individualized investment advice or a solicitation to buy or sell any instrument. Market Vision LLC receives compensation to publish favorable, promotional information about featured instruments; this creates a fundamental and material conflict of interest under SEC Rule 17(b), and you must always assume a conflict exists. The publisher and its affiliates may hold and trade positions in any featured instrument and may liquidate (i.e., "pump and dump") those positions at any time without notice. All trading involves SUBSTANTIAL RISK, including the complete and total loss of all capital. You are SOLEY responsible for your own independent due diligence and investment decisions. By accessing this content, you agree to the full terms, including mandatory binding arbitration in Texas and a WAIVER of jury and class action rights. Read full disclaimer in the footer of this website.